Tag: Securities and Exchange Commission

-

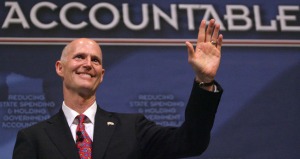

You don’t need X-ray vision to see through Gov. Rick Scott’s blind trust

By Dan Christensen

FloridaBulldog.org

Gov. Rick Scott keeps his $127.8 million stock portfolio in a blind trust, but the trust isn’t doing its job of preventing him from having knowledge or control of his investments. The blind trust keeps the governor’s assets out of sight of the public, but fails to blind him to his investments. -

/

5238 SEEN/

How Medicare Advantage investors made billions off loose government lips

By Fred Schulte

Center for Public Integrity

The third of February 2011 was mostly a ho-hum day on Wall Street — but not for companies offering Medicare Advantage plans. Several of those firms hit the jackpot, tacking on billions of dollars in new value after federal officials signaled they might go easy on health plans suspected of overcharging the government. -

/

12699 SEEN/

Florida’s First Lady invests quietly in investment firm that mirrors governor’s old company

By Dan Christensen

BrowardBulldog.org

Florida First Lady Ann Scott doesn’t talk publicly about where she invests the many millions of dollars in assets her husband, Governor Rick Scott, has transferred to her since his election in 2010. But SEC records reveal one place she’s sunk a lot of money is an obscure “family” investment firm that boasts $160 million under management and operates using the online name Scott Capital Partners. -

Gov. Scott chose a familiar face to manage his $72 million blind trust

By Dan Christensen

BrowardBulldog.org

Most Floridians have never heard of Alan Lee Bazaar. Yet as chief executive of the New York investment advisory firm that serves as trustee of Gov. Rick Scott’s blind trust, Bazaar is the keeper of an important public trust for Florida’s citizens. -

Gov. Scott quietly rakes in millions from stock sales; Florida’s blind trust law ineffective

By Dan Christensen

BrowardBulldog.org

Over the last 15 months, Gov. Rick Scott and his wife, Ann, through various entities, made more than $17 million selling hundreds of thousands of shares a single stock. Scott’s blind trust sold shares of that stock worth $2.54 million in December 2012. You aren’t supposed to know that. Gov. Scott isn’t supposed to know it either. -

/

4580 SEEN/

Ex-SEC chief now helps companies navigate post-meltdown reforms

By Lauren Kyger, Alison Fitzgerald and John Dunbar

Center for Public Integrity

On March 11, 2008, Christopher Cox, former chairman of the Securities and Exchange Commission, said he was comfortable with the amount of capital that Bear Stearns and the other publicly traded Wall Street investment banks had on hand. Days later, Bear was gone, becoming the first investment bank to disappear in 2008 under the watch of Cox’s SEC.

Support Florida Bulldog

If you believe in the value of watchdog journalism please make your tax-deductible contribution today.

We are a 501(c)(3) organization. All donations are tax deductible.

Join Our Email List

Florida Bulldog delivers fact-based watchdog reporting as a public service that’s essential to a free and democratic society. We are nonprofit, independent, nonpartisan, experienced. No fake news here.